Rural focused fintech startup Navadhan has raised INR 111 crore in its Series A round, interesting thing is that the company raised more than its initial target of INR 80 crore. The round was led by NabVentures, venture capital arm of National Bank for Agriculture and Rural Development (NABARD) with co-lead from Prime Venture Partners.

The oversubscribed round saw participation from LNB Group, which invests in tech startups through venture capital funds and alternate investment funds (AIFs) and existing investors Varanium NexGen Fintech Fund, Gemba Capital, Faad Network, VC-Grid and Anicut Capital. This is Navadhan’s fourth funding in the last three years, a testimony to the confidence investors have in its business model and growth.

Growing and Expanding the AceN Platform

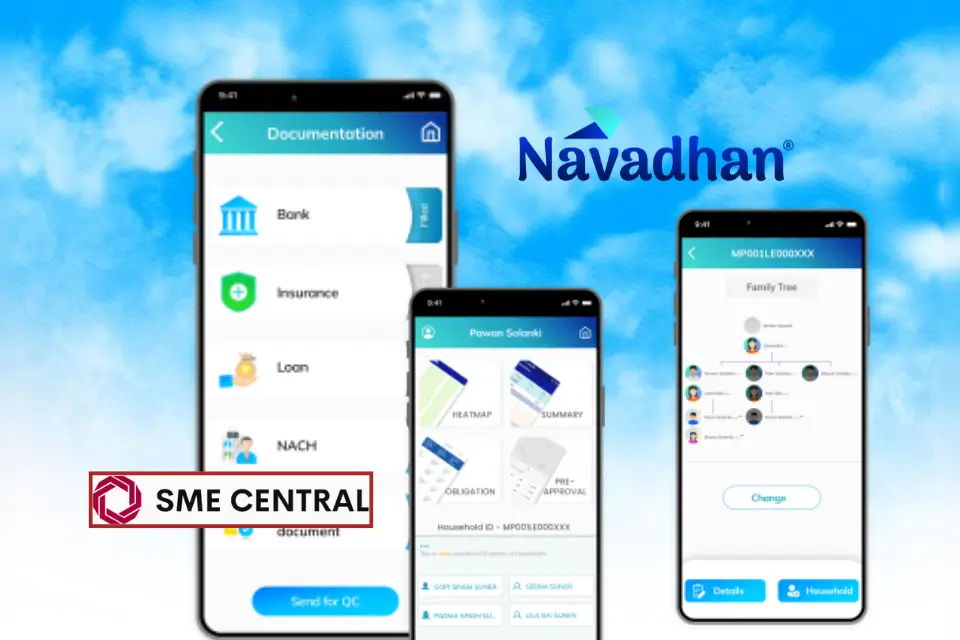

Navadhan is an NBFC founded in 2019 by Nitin Agrawal, Vijay Haswani, Anirudh Ramakuru and Amit Biswal. The company provides financial solutions to rural micro, small and medium enterprises (MSMEs) through its proprietary technology platform, AceN.

The newly raised capital will be used to scale up business, enhance the AceN tech stack, diversify loan offerings and deepen presence across rural India. Currently, the company has over INR 700 crore of debt lines available through partnerships with more than 25 banks and NBFCs facilitated by API based integrations on the AceN platform.

Hear from Nitin Agrawal, Founder of Navadhan: “We are happy to have investors who share our mission of creating new wealth (Nava-dhan) for rural-preneurs. At an early stage, tech investors helped us build the AceN tech platform. We are now excited to have NabVentures on board, as rural MSMEs are our core customer segment.”

Also Read: Nikhil Kamath-Backed Nourish You Raises INR 16 Cr in Series A Round, Led by SIDBI Venture

A Hybrid Model

Navadhan follows a “brick-to-click” model, a combination of on-ground presence with fully digital workflow. The first two years were dedicated to building the AceN platform and then the company started lending. AceN offers end-to-end paperless customer fulfillment workflow for customer onboarding, digital underwriting, servicing and multi-mode collections. The platform uses data science backed alternative underwriting models to assess digital footprints and cash flow surrogates to address the lack of formal income documents in rural and semi-urban markets.

“Navadhan’s AceN platform is one of the most advanced systems built on IndiaStack, with differentiated underwriting capability reflected in their numbers,” said Sanjay Swamy, Managing Partner at Priven Advisors, advisor to Prime Venture Partners.

Read Also: Beauty and Personal Care Startup Pilgrim Raises INR 200 Cr in Funding

Investors Backing

Ashish Choudhary, CIO of NabVentures, commented: “Navadhan has demonstrated calibrated growth of 12x in the last three years while maintaining good asset quality. The AceN platform has been instrumental in enabling seamless co-lending and leveraging capital more efficiently than traditional NBFCs.”

Amit Mehta of LNB Group added: “We believe Navadhan has the right founder-market fit and the focus on building a capital-efficient lending network, particularly in the priority sector lending space. The company is at a pivotal stage, poised for sustainable growth for years to come.”

Navadhan currently serves more than 700 PIN codes across five states—Madhya Pradesh, Rajasthan, Gujarat, Karnataka, and Odisha. The company plans to deepen its presence in these geographies while also diversifying its credit products to meet the evolving financial needs of rural MSMEs.

Cumulative Funding and Road to Scale

With this latest funding round, Navadhan’s cumulative fundraising, including equity and debt lines, now stands at USD 16 million. Previously, the company raised USD 5 million in a pre-Series A round in December 2023, led by Prime Venture Partners. In June 2023, Navadhan secured USD 1.5 million in a seed round led by Varanium NexGen and Anicut Capital.

As India’s fintech sector continues to attract significant investor interest—having raised over USD 2.5 billion across 162 deals in 2024—Navadhan’s focused strategy of connecting banks and NBFCs with under-served small businesses positions it as a key player driving financial inclusion and rural entrepreneurship in the country.